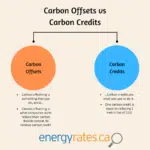

While carbon offsets are often used interchangeably with carbon credits, they are different from each other. Carbon offsetting is something that you do – while a carbon credit is what you use to do it. Understanding the difference between them is important for businesses and for individuals looking to address their environmental impact as time goes on. At their core though, both carbon offsets and carbon credits are accounting mechanisms for companies to use to buy and sell their offset emissions. They provide a way to balance the scales of pollution, and since CO2 is the same gas anywhere in the world, it doesn’t matter where emissions reductions happen.

Our article below will explain the differences between them and all of the key differences explained. There are also different efforts taken towards green energy and smaller carbon footprints, such as VPPA’s and other carbon accounting– but this article will be covering green plans, carbon offsets, and carbon credits.

What are carbon credits?

Carbon credit as a concept originated decades ago as a mechanism to fund the reduction of carbon emissions. One carbon credit represents the reduction of 1 metric ton of CO2 from the atmosphere. There are typically two types of carbon credits: voluntary and compliance. Compliance carbon credits are relevant for only a small number of very large companies, such as existing in government-regulated cap-and-trade carbon markets that are isolated to specific high-emission industries like power generation or heavy manufacturing.

In regulated carbon markets, the government identifies an industry that is responsible for significant carbon emissions, and establishes a carbon emission limit for each facility (referred to as a cap) and enforces financial penalties on ones that exceed their cap. Companies that have carbon emissions below their cap are given credits that they can sell to facilities that are over their cap – hence a term called cap-and-trade. Notable regulated carbon market includes CARB in the United States in California, the Regional Greenhouse Gas Initiative known as the RGGI, and the China Emissions Trading System to name a few. Canada also has one called the Canadian Greenhouse Gas Offset Credit Regulations, which encompasses more than just regulated carbon credits.

Voluntary carbon credits are on the flip side of the coin and are generated by projects that are implemented exclusively to reduce carbon emissions. Voluntary carbon credits rely on the sale of carbon credits for funding and have no other regulatory or financial incentives to exist. These projects are basically carbon reduction factories, for lack of better terms. These carbon reduction projects are major capital projects just like operating and building a manufacturing plant that requires a significant up-front investment and ongoing operating expenses. They need constant carbon credit revenue for decades to recoup the cost of construction and operation and every year that these projects reduce carbon emissions, they generate carbon credits that they sell to keep the doors open.

For both companies/businesses and consumers, it makes financial sense to reduce emissions where it’s cheapest and easiest to do, even if it doesn’t involve their own operations. At its simplest terms or level –

- A carbon offset or credit represents a reduction in or removal of greenhouse gas emissions that compensates for CO2 that is emitted somewhere else. They do have similarities in common, such as these two major points:

- One carbon credit or offset equals one ton of carbon emissions

- Once a carbon credit or offset is purchased and the CO2 is emitted, that credit is then ‘retired’ as it can not be sold or used again.

Carbon offsets: Removes GHGs from the atmosphere.

Carbon credits: A reduction in GHGs released into the atmosphere.

As an example, to visualize the differences, imagine a water supply polluted by a nearby chemical plant or similar. An ‘offset’ would mean pulling chemicals out of the water to help purify it. Meanwhile a ‘credit’ would mean paying another chemical company to release fewer chemicals into the water, so the overall level of pollution stays the same. All around – it’s similar but they are different after all.

What’s the difference between green plans and carbon offsets?

Green plans and carbon offsets may seem similar, if not exactly the same when you have them together. The main difference between green plans and carbon offsets is within the time scale on which they operate – both are important of course when it comes to addressing climate change and reducing our carbon footprint, but one is more focused on the future while the other is more set in the present day.

Green plans are meant to address the future and how we can take steps to get there. They involve reducing CO2 emissions and creating better overall climate strategies, among other broader environmental policies. Green plans are crucial for long-term prosperity and reducing out footprint on the environment, and helping combat against ending up in a severe climate crisis.

Carbon offsets, on the other hand, are designed to impact and affect the present day. They work to address indirect and direct carbon emissions through reductions carried out by external projects that either capture CO2 emissions or avoid its release into the atmosphere measurably. Offsets are typically measured in verified emissions reductions, which are subtracted from emission totals to determine net overall emissions. These can be used by any group or individual that wishes to lower net CO2 emissions, from businesses and large-scale organizations to singular people just trying to offset their own carbon footprints for the year.

- Green plans focus on the future and how we address steps to reduce our footprints overall.

- Carbon offsets are designed to impact the present, right now, to address direct and indirect carbon emissions carried out by external projects that either reduce or capture CO2 emissions as they go.

The biggest carbon credit markets across the globe

There are several carbon credit markets across the globe, with China being the largest operational emissions trading market in the world. The country’s ETS, which was introduced in July 2021, covers around 5 billion metric tons of carbon dioxide equivalent (known as GtCO2E). As of 2024, the European Union ETS covered around 1.4 GtCO2E in comparison. Canada itself is striving towards more green energy and has been involved in co-generative plants and other carbon offsets as well.

The biggest carbon credit markets across the globe vary, as there is a lot of information and different category markers for what determines the best credit markets. Below is a list of the biggest carbon markets across the world and includes some rankings as well.

Best Voluntary Carbon Market Rankings from Environmental Forecast 2024

- Best Carbon Exchange – ACX (AirCarbon Exchange)

- Best market innovation – Viridios AI

- Best crediting innovation (non-carbon) – International Carbon Registry

- Best individual offsetting project – Carbon WAVE

The carbon market is dominated by a few major players that have a wide regional presence. The major players in the carbon offset market are:

- South Pole Group (Switzerland)

- 3Degrees (United States)

- Finite Carbon (United States)

- EKI Energy Services Ltd. (India)

- NativeEnergy (United States)

If you’re an individual or corporate consumer looking to work on lowering carbon emissions, carbon footprints, and don’t know where to start – EnergyRates.ca has you covered with in-depth articles including VPPA’s, what they are, green energy plans, and other tools to help you become more energy efficient and sustainable. There are energy certification information, carbon offsets, and more.